Betting against volatility has become a profit-minting machine in currency markets. So much so that Wall Street firms say clients are giving up on wagers that go in the opposite direction.

That’s a seismic shift in the $7.5 trillion-a-day foreign exchange market. The fluctuations that traders historically used to play with have largely vanished as a new breed of algorithmic traders bet markets will remain calm. To the heads of currency derivatives at Bank of America Corp., NatWest Group Plc and UBS Group AG, it’s creating a cycle that keeps feeding profits to anyone in favor of ever-smaller swings.

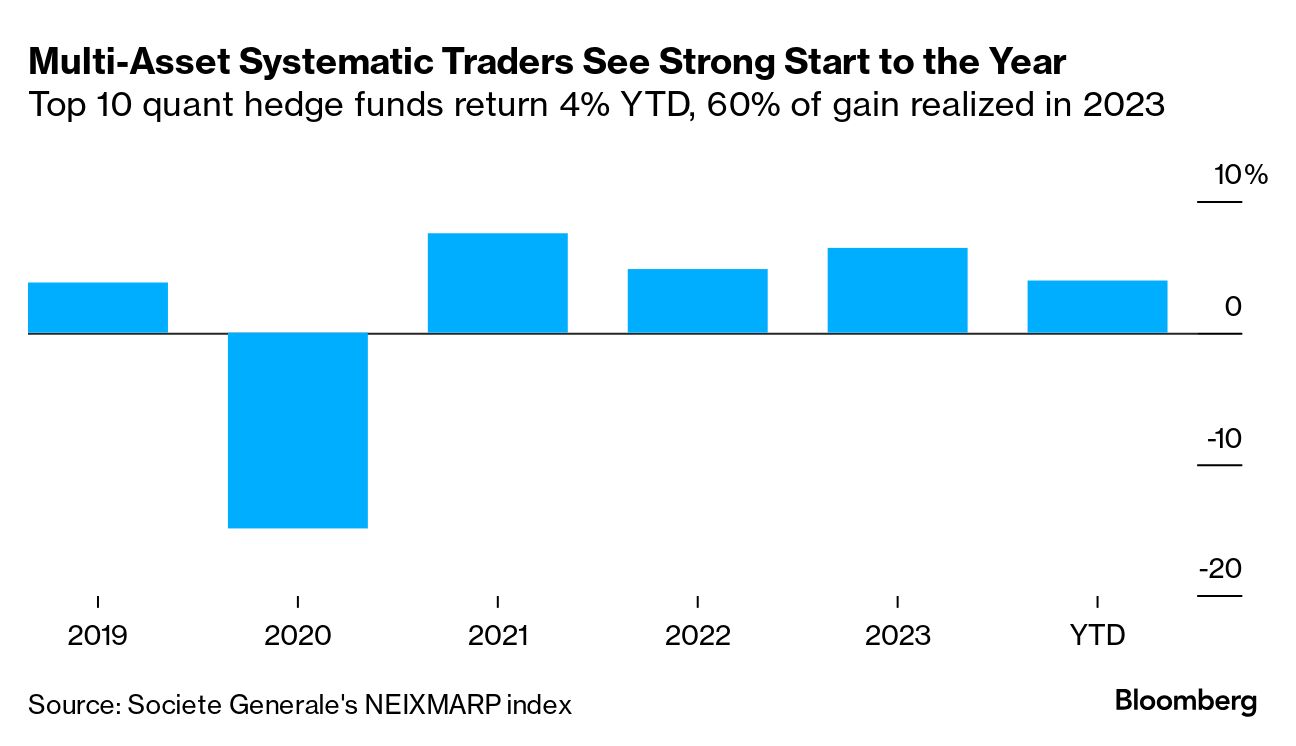

It’s emblematic of a short-volatility trend reshaping markets from stocks to commodities, and leading some to question whether this subdued environment is the new reality. Of course, the risk is that the computer-driven funds are wrong and the next market flare up is just around the corner.

“The emergence and dominance of systematic volatility selling funds is a bit self-fulfilling,” said Henry Drysdale, head of currency options trading at NatWest Markets in London. “If the strategy is successful, more enter the space and it gets quite crowded, with more and more participants selling volatility at lower and lower levels.”

Take Loomis Sayles & Co.’s alternative risk premia fund, which uses machine learning to target inefficiencies and behavioral biases in volatility markets. It returned 15% over the last year and is continuing to position for lower volatility.

“These strategies can be tremendously profitable,” said Harish Sundaresh, head of systematic investment strategies at the Boston-based firm. Still, he warned against any view that the easy money would last for more than five years at a time. “It’s almost like picking up pennies in front of a steamroller kind of trade.”

Betting on Calm

The volatility selling has already sent JPMorgan Chase & Co.’s Global FX Volatility Index plummeting to the lowest level in three years. Even notoriously dramatic emerging-market currencies have gone quiet.

Traditionally, asset managers would use this as a chance to snap up cheap hedges against bigger swings, but now they see little reason to get that protection. Large hedge funds are also pulling out of the market.

“We’ve lost a few sizable buyers of volatility,” said Mathieu Reaud, global head of FX and precious metals derivatives trading at UBS. “It’s been very difficult to monetize those strategies.”

Read more: Currency Hedges Are Burning Traders’ Wallets as Volatility Fades

Another reason for calm markets is that major central banks are expected to cut interest rates this year and that’s pushing currencies in a similar direction.

“There’s no natural impetus for foreign-exchange moves if you believe most central banks will do the same thing,” said Julian Weiss, head of global G-10 vanilla FX options at Bank of America. “We’re in a vicious cycle of foreign-exchange spot prices hardly moving, and less demand for leveraging directional macro plays.”

Calmer currencies do have benefits. It’s helpful for planning by policymakers and multinational firms. It’s also good for carry trades, a strategy of borrowing in low-yielding currencies to fund positions in higher-yielding ones.

But overall it’s adding up to a harder environment to make money trading shifts in currencies. Over 80% of specialized FX funds have quit since 2007, as the effect of tighter post-crisis regulation and industry electronification plays out.

Read more: A New Short-Volatility Trade Is Booming Across the ETF Complex

Of course, there’s a risk when everyone piles into one side of a trade. Four years ago, gauges of volatility were also getting crushed, and traders were wondering if there was a future betting on price swings. Then the pandemic struck, and volatility spiked to levels seen in past financial crises.

False Security?

“Short volatility strategies can act like a gravity force, stabilizing the market and offering a false sense of safety,” said Sandrine Ungari, head of cross-asset quantitative research at Societe Generale AG. “All it takes is one big event to put a halt to that.”

Read more: Black Swan Needed to Revive Collapsed FX Volatility: Trader Talk

Yet there’s no sense the market is worried about risks on the horizon, such as rate cuts or elections in the US and UK. One-year gauges of volatility in the euro, pound and yen are at multi-year lows.

Amundi SA, Europe’s largest asset manager, says low volatility will continue. It’s using options that will pay off if the euro and yuan trade in a limited range.

“It’s possible that we go another year and volatility doesn’t go up,” said Andreas Koenig, head of global FX at Amundi. “I can’t see any trigger at the moment.”

--With assistance from Vassilis Karamanis, Naomi Tajitsu and Justina Lee.